RESEARCH & DEVELOPMENT FOOD AND BEVERAGE

If your business has been focusing on improvements to flavours, shelf life, and nutrition, it’s likely that you’ll qualify for R&D incentives relief.

If you’re a food or beverage manufacturer and you’ve recently developed new products, improved existing ones, or even enhanced your packaging – there is a strong chance that you could benefit from a Research and Development (R&D) Tax Credit claim or you could receive more than you’ve already claimed for.

The food and drinks industry never stands still and companies are continually looking to enhance their products. Whether it be ensuring that they keep up with the latest customer trends, deliver foods that taste great, or developing sustainable packaging that keeps food pristine, there is always a project to keep the New Product Development (NPD) teams busy.

Investing in R&D can help you create new products or improve existing ones by looking at ways in which you can claim up to 33.35% cashback on qualifying R&D spend.

R&D TAX CREDITS FOR THE FOOD AND BEVERAGE INDUSTRY EXPLAINED

The UK government wants to reward and fuel research and development in the food industry. If your business has been focusing on new product development, including improvements to flavours, shelf life, and nutrition, it’s likely that you’ll qualify for R&D incentives relief.

With so much news in the press about increased obesity rates and changes in legislation to sugar content, now is a great time to receive cash incentives to make improvements to your existing product range.

Further developments may also be eligible for R&D incentives.

WHAT TYPE OF FOOD AND BEVERAGE PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

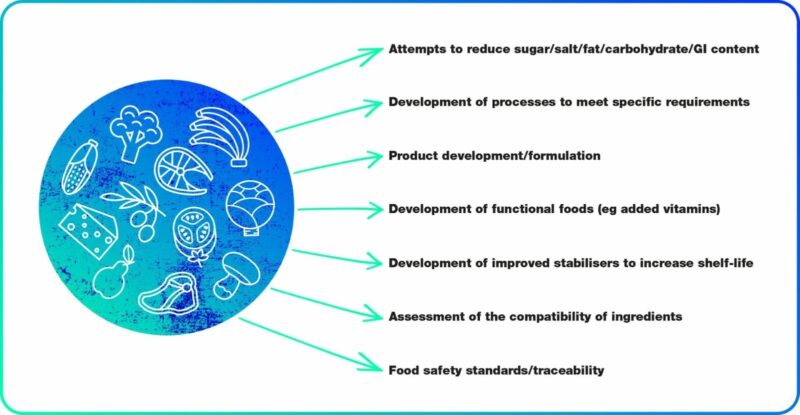

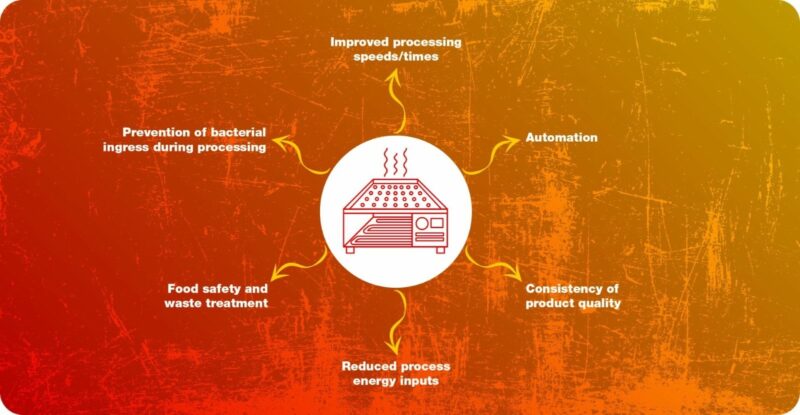

A broad range of engineering projects can meet the Government’s R&D definition, for example:

MANUFACTURING FOOD

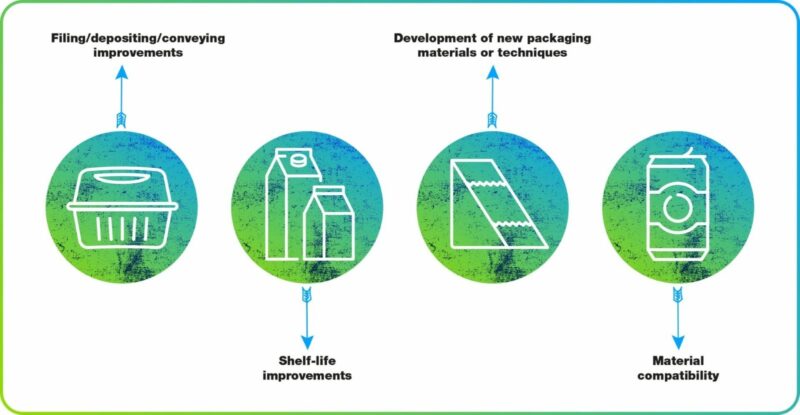

PACKAGING

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN THE FOOD & BEVERAGE INDUSTRY?

We speak to so many businesses that don’t feel like they qualify for relief. They think they’re “simply doing their day job”. We think the name ‘Research & Development’ is misleading. It makes people think of lab coats, test tubes, innovation centres.

In reality, R&D pretty much comes down to two qualifying criteria: 1) you’ve made some changes/improvements to your product or manufacturing process; and 2) these changes weren’t obvious or easy and you didn’t know exactly how to make them work from the off.

So, have you ever improved a product? Have you developed one further? Changing ingredients to improve the nutrition of a product could qualify too. And if you’ve made improvements and could quite easily say, “those changes took some thought, some time, and some testing,” it’s time for you to consider your eligibility to claim R&D incentives’

WHY COOPER PARRY?

In three years we’ve put more than £61 million back with businesses. We’ve obtained in excess of £3 million for companies that had already claimed. And we’re a member of the government’s Research and Development Consultative Committee,

Our experience and dedicated R&D incentives specialists means we know what to look for and we know where to find it.

Let’s talk today

Want us to call you? Let’s start a conversation!

Get in touch with Rebecca Prince

Latest News

Reviews

BSAP, JUNE 25

“Great communication.”

LAURA, JUNE 25

“Although the service we have received has been extremely good, there has been long delays in partner reviews.”

GARETH, JUNE 25

“Great relationship with Audit Partner and Audit Manager which means resolutions are reached quickly on difficult and complex issues. The accounts are put together in an efficient and well presented manner. The audit team generally adopt a logical and pragmatic approach. Only real negatives were that Kennedy audit was a more a drawn out process than perhaps it needed to be. Reconciling the consolidated accounts back to the Cooper Parry calcs was complex and there were some small discrepancies. As discussed with the Audit Partner I do have some concerns on the level of fees.”

AATAP, JUNE 25

“Great conference, helpful team and super service. Thank you.”

CHERILYN, JUNE 25

“The account were turned around quickly, and we were kept up to date with the progress of the audit”

LUCIE, MAY 25

“Easy communication, always get back to me promptly, provide advice when needed, like the Inflo system very user friendly.”

HAYLEY, MAY 25

“The recent external audit and financial statement preparation were executed with professionalism and thoroughness. The auditor team demonstrated strong technical expertise and diligence, ensuring the process was both comprehensive and transparent. Their approach to testing, particularly in collaboration with the ASCL PD team during the first week, was highly effective and contributed to a smooth progression of the audit work, especially given its proximity to the annual conference. One area of improvement would be the timeline planning. The current schedule presents significant pressure in ensuring all necessary work is completed within tight deadlines. We have already discussed the potential benefits of moving some of the audit activities forward and setting clear dates in advance. Proactively scheduling key milestones would allow for better resource allocation and smoother execution. Another area of improvement would be the team working with their internal colleagues to check the partial VAT and advise on the changes to make for the next financial year. Additionally, the format and content of the audit findings report received positive feedback from elected officers. Its clarity and structure enabled effective review and discussion, reinforcing its value in financial oversight. Overall, the service provided was impressive, and the auditors’ commitment to delivering a high-quality review is appreciated. With a few refinements to planning and scheduling, the process could become even more efficient in future audits.”

PAULINE, MAY 25

“Great team, fit well into our office, professional approach whilst both friendly and very supportive. Pleasure to work with.”

MARION, MAY 25

“Communication was excellent and timely and the upload and action processes very smart and effective. Audit staff were friendly and helpful throughout the process.”

EDWARD, MAY 25

“Just very easy to deal with, all very relaxing to be honest!”