MANUFACTURING

If you operate a manufacturing business and you’ve recently developed new or improved products or processes, then there is a strong chance that you could benefit from a Research and Development Tax Credit claim.

Whilst R&D may sound like complex tax relief, only available for scientists who are pursuing ground-breaking developments. It is also available to so many other businesses that are improving existing products, developing new ones, or improving processes.

Almost every business will be doing some sort of activity that meets the criteria for claiming the incentives. But sadly, a lot of these businesses are missing out, either completely by making no claim at all, or in part, by not including everything they can. And with up to 33.35% cashback available on qualifying R&D spend, that’s criminal!

R&D TAX CREDITS FOR MANUFACTURING EXPLAINED

R&D in manufacturing most commonly relates to the development of products or processes. It’s inevitable that many businesses continue to advance their existing product range. And if this advancement involves an element of head-scratching and problem solving to overcome technical difficulties, it’s likely the project will qualify for R&D incentives.

WHAT TYPE OF MANUFACTURING PROJECTS CAN QUALIFY FOR R&D TAX CREDITS?

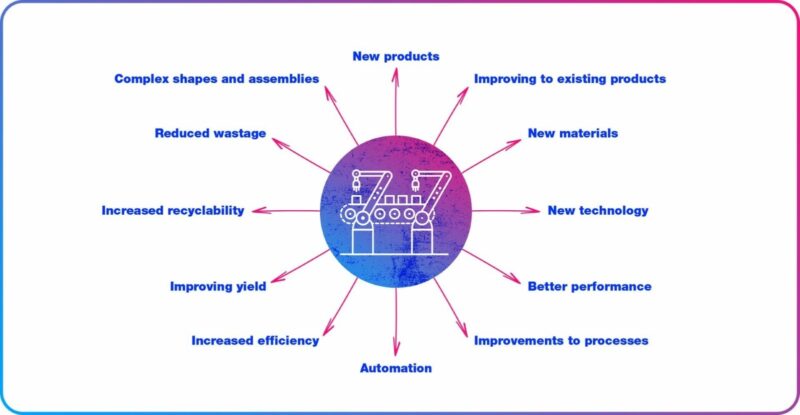

A broad range of projects can meet the Government’s R&D definition, for example:

PRODUCTS DON’T HAVE TO BE UNIQUE TO QUALIFY

R&D incentives can be applied to any business that designs or makes something… anything! The thing you’re making could even be being made elsewhere too.

It’s likely you’re not using the same materials or following the same standards as your competitors. You might be light-weighting, working in different space constraints, and so on. There are so many things that differentiate your product or the processes you use to put it together. And after working on the R&D scheme since it began in 2000, we know exactly where to look to maximise your claim.

WHY IS RESEARCH & DEVELOPMENT IMPORTANT IN MANUFACTURING INDUSTRIES?

We speak to hundreds of businesses that think they don’t qualify for the relief, which makes the eureka moment all the more sweet.

That’s because R&D boils down to two qualifying criteria. Firstly, have you made a change or an improvement to a product or your manufacturing process? And secondly, did those changes take some time, some thought or some testing?

If you can answer “yes” to both of those questions, it’s time for us to have a chat, because R&D tax incentives are a fantastic way to keep your business and your cash flow on the front foot.

R&D MASTERCLASS FOR MANUFACTURERS

Still unsure about the reality of R&D for your business? Watch below our R&D Incentives Partner, Chris Knott, who highlights the importance of R&D for manufacturing businesses and why we need to stop calling it R&D.

WHY COOPER PARRY?

In three years we’ve put more than ££61 million back with businesses. Our experienced and dedicated R&D incentives specialists means we know what to look for and we know where to find it.

Let’s talk today

Want us to call you? Let’s start a conversation!

CLIENT TESTIMONIAL

“The results exceeded our initial expectations, once we started discussions, it became clear that we could claim for more than we anticipated. I found the process both informative and straightforward. The additional cash has enabled us to increased pension payments, and give us a little more security in purchasing stock.” – Dominic Hall, Watergen

Latest News

Reviews

GREG, JUNE 24

“Pragmatic, balanced audits delivered on time and on budget. Thank you!”

MATTHEW, JUNE 24

“Professional service. Good communications.”

JAMES, JUNE 24

“Results in line with expectations – from a cash perspective lower than hoped but I feel CP helped us get the max for the spend we had.”

TOM, JUNE 24

“The audit team are very easy to deal with and take a common sense approach which helps to make the audit process as pain free as possible. The staff are always friendly yet professional. Any queries and requests raised are always sensible and valid. The fees are also competitive.”

MARTA, JUNE 24

“An improvement from last year, weekly catch ups definitely helped to mange the workflows.”

RACHAEL, JUNE 24

“I feel I have a great relationship with David, and we understand each other. We have between us, had a great year end and was very happy how we completed the accounts..”

MARCUS, JUNE 24

“Very supportive as we have brought the audit forward this year. Technical guidance is relevant and timely. Tax support well rounded across all relevant areas.”

ANDY, JUNE 24

“CP team have been approachable, knowledgeable and fun to work with. Improvements? Perhaps a few more blogs/technical updates.”

KATE, JUNE 24

“Good communication, timely input, available when we need you..”

JAMES, JUNE 24

“The first audit has been performed efficiently with excellent communication and without any issues of note.”