Rishi Sunak announced a planned increase in Corporation Tax rates to 25% from 1 April 2023. This is a sharp hike from the current rate of 19% causing an area of contention for many UK business leaders.

However, as tax rates rise, reliefs become even more valuable, creating more reason for businesses to maximise their claims.

For example, SMEs claiming R&D relief will see the value of their claims increase. The increased rates also generate tax planning opportunities for loss making companies.

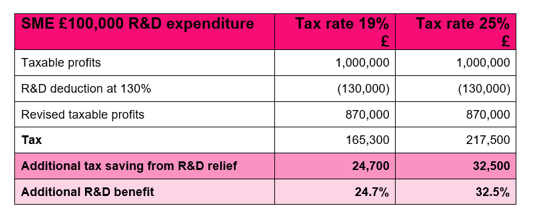

The reason the SME R&D regime becomes more valuable is because the scheme provides an additional deduction from taxable profits, thereby generating tax savings at a higher rate from April 2023.

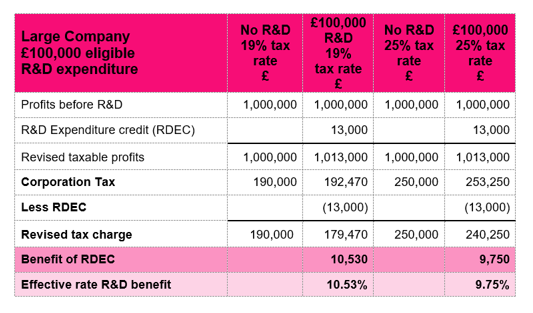

In contrast, the opposite will be true for large companies claiming under the R&D Expenditure Credit (RDEC) scheme. This is because the large company regime provides a taxable credit, meaning higher corporation tax rates will erode the net benefit.

SMES GENERATING TAXABLE PROFITS

The main corporation tax rate is proposed to increase to 25% from 1 April 2023 for companies generating taxable profits of more than £250,000. Profits below £50,000 will continue to attract a 19% rate. Profits between £50,000 and £250,000 will attract marginal relief, to ‘smooth’ the rise from 19% to 25%.

We therefore look at what this could mean for SMEs claiming under the SME scheme.

SMEs can claim 130% additional deduction from taxable profits for R&D qualifying expenditure. As shown in the example below, if a company identifies £100,000 R&D qualifying expenditure, this will create a deduction from profits of £130,000. This deduction will therefore provide additional tax relief at 32.5%, which is significantly more beneficial than claims made when a 19% corporation tax rate applies (which provides an additional 24.7% benefit).

SMES GENERATING TAX LOSSES

Where SME R&D relief contributes to a tax loss, then this may be ‘surrendered’ to HMRC to provide a repayable credit. This option allows cash strapped companies, who are investing heavily in R&D, to receive the benefit of the regime through an upfront cash payment rather than waiting until the R&D enhanced tax losses relieve future profits.

The scheme allows the taxpayer company to surrender losses with a value of up to 230% R&D expenditure in exchange for a repayment. The repayment is calculated at 14.5% of the losses surrendered, providing total tax relief at a rate of 33.35%.

As the tax rate increases, the value of these losses becomes more attractive, potentially relieving profits that would otherwise be subject to tax at 25%, rather than achieving a repayment at a comparatively low rate of 14.5%. Tax planning opportunities therefore arise which may lead companies to carry forward losses rather than surrender them, or even amend prior year claims to bank future relief in preference to the credit.

LARGE COMPANIES

Finally, the not-so-good news for large companies is that the increased tax rate will erode the benefit of the large company scheme. The scheme, known as R&D Expenditure Credit (RDEC), provides companies with a taxable credit calculated at 13% R&D expenditure. The credit is accounted for ‘above the tax line’ therefore increasing operating profit and ultimately incentivising big businesses to invest in R&D.

However, as shown by the examples below, a company paying the full rate of 25% corporation tax will see the net benefit of the RDEC regime reduced from 10.53% to 9.75%.

The Government has suggested that it will increase the benefit of the RDEC regime, with further detail expected in the Autumn. However, if the corporation tax rate rises to 25%, the gross credit will need to increase to 14% to remain comparable with the current net benefit.

For large businesses to see a real increase, the gross credit will need to exceed 14%, so we wait eagerly for the news!