Mark Frost

CP Innovation Partner

1 Reply:

We can help you join the dots and access funding and investment before starting on your R&D journey.

Research & Development (R&D) tax relief claims are a core part of the support the CP Innovation team offer companies. It’s worth taking a look at the full range help that the team can provide to businesses. From Creative Tax Reliefs, Intellectual Property and Patent Box through to help accessing grants and business support. R&D tax relief is a government incentive to reward the time and investment businesses put into creating or improving products, processes or services. They encourage innovation. And they keep UK businesses and our economy on the front foot.

Some businesses would love to carry out more R&D activity. And make a claim. But they’re caught in the trap of not having the money to invest in research activity. They’re potentially missing out on a cash injection to their business or a reduction in their tax burden from a successful claim. CP Innovation can help you join the dots. We know you might need to access funding and investment before starting on your research and development journey. You may need access to specialist scientific knowledge or need academic support. Take a look at the information below which will tell you more about R&D tax relief and the potential benefits for your company. Then talk to us.

R&D is when businesses actively improve and develop new products and processes. It helps businesses remain competitive, launch new offerings, improve existing ones and make a profit. However, we’ve found R&D sounds too complex. Too much like rocket science. And it sets the bar too high in people’s minds about what qualifies and what doesn’t.

We remove the misconceptions. And we’ll show you there’s a lot more to R&D tax credits than white coats, labs and innovation centres. Put simply, it comes down to two things:

So, if you’ve made changes that took some thought, some time and some testing – it’s time for us to talk. “R&D”, for tax relief purposes, is more than what you may think.

This is the package of financial support provided to UK businesses by the Government via the tax system to encourage Research & Development (or ‘R&D’) activities. In other words, a mechanism by which to reward companies for the development of new or improved products, processes, and services.

The R&D tax incentives regimes have been designed to incentivise companies incurring costs undertaking scientifically or technologically challenging projects. It is called “R&D” but the sort of projects which can qualify are much broader.

R&D tax credits are a specific subset of the suite of R&D tax incentives available for businesses. However, these are commonly and collectively referred to as R&D tax credits. To avoid confusion, we will provide everything you need to know about R&D tax incentives but using the R&D tax credits terminology. There will be more on the differences later.

There are two halves to R&D tax credit claims; technical and financial.

To qualify for R&D tax credits a company needs to be undertaking technical activities that meet a special definition of R&D for tax purposes. The good news is that R&D for tax purposes is far wider than companies often initially expect. For a project to qualify for R&D tax credits it must meet the following two criteria:

Simply put, projects that include some element of improvement, where there is not an obvious or standard technical solution, will potentially qualify. You can find further commentary on the qualifying R&D criteria and how these are derived from the Department for Business, Energy and Industrial Strategy (‘BEIS’) Guidelines here.

It is important to note that R&D tax credits are not specific to any one sector or industry, so if you are in food or engineering, retail or software, agriculture or manufacturing, the likelihood is that your business will be undertaking some form of qualifying R&D activity.

You may ask who can identify the qualifying R&D activity in my business? There is one, and only one, answer to that question. It is not your Finance Director. It is not your Tax Manager. It is not your Accountant. It is not even your R&D tax credits adviser. It is the technical people in your business who are best placed in the business to understand the R&D being undertaken and apply the BEIS guidelines. For R&D tax credit purposes, these people are competent professionals. Only your competent professionals are suitably qualified to identify the R&D activities in your business.

Secondly, your business must be incurring qualifying R&D expenditure and therefore you need to identify costs that you have incurred in undertaking the R&D projects. You can claim internal staff costs, payments to contractors or third parties supplying workers, consumables, software licenses, and expenditure on water, fuel, and power.

Your business has less than 500 employees and either not more than €100 million turnover or €86 million gross assets. This is measured on a global group basis, so if your business is part of a group, or connected to other businesses you may need to consider their financials as well.

If your company is not eligible to claim under the SME criteria mentioned above, you may be in a position to claim under the large company scheme.

Let’s start with an advance in science or technology. The Guidelines provide examples of what an advance in overall knowledge or capability in a field of science or technology may be.

Extending overall knowledge or capability in a field of science or technology i.e., generate new knowledge. Are you developing knowledge of a new process that is not available in the public domain? Or are you finding new uses for materials that have not been proven previously? These could be examples of extending the overall knowledge or capability in the field.

Creating a new process, material, device, product or service which incorporates or represents an increase in overall knowledge or capability in a field of science or technology. Are you creating something completely new that did not exist before? Is your product the first to the market or the first to be developed in that way? This is not just in your business, but in the entire public domain. Or are you building upon existing knowledge or technology? If so, this may be more aligned to an appreciable improvement in 3).

Making an appreciable improvement to an existing process, material, device, product or service through scientific or technological changes. Are you taking an existing technology, product or process and improving it by making changes of a scientific or technical nature? Most companies fall into this category as they are often building upon their own existing products and the knowledge in the public domain.

Use science or technology to duplicate the effect of an existing process, material, device, product or service in a new or appreciably improved way. Are you attempting to create a product that has the same properties of an existing product but for half the price? Or maybe you are seeking to improve a process by modifying a technology from another industry.

In short, if your business has technical people working on projects that have a scientific or technological aspect, there is potential that they will qualify. A couple of important points that are often missed:

So, what is scientific or technological uncertainty? This is where achieving the advances sought is not routine and can come in many different forms:

There is a judgement to be made by the company’s “competent professional” as to whether a scientific/ technological challenge is routine/readily deducible to resolve (i.e. not R&D) or is scientifically/technologically uncertain to resolve.

The company’s R&D effort starts from the moment the company commences resolving scientific/technological uncertainty, e.g. feasibility studies early in the project lifecycle, and ends when the company is confident the uncertainties have been resolved, e.g. during testing/trials.

R&D that fails and is aborted can still qualify for relief. R&D typically ends once a product or process has been brought to market. However, it may re-start if new scientific/technological uncertainties arise that need resolving to create an improvement after this time.

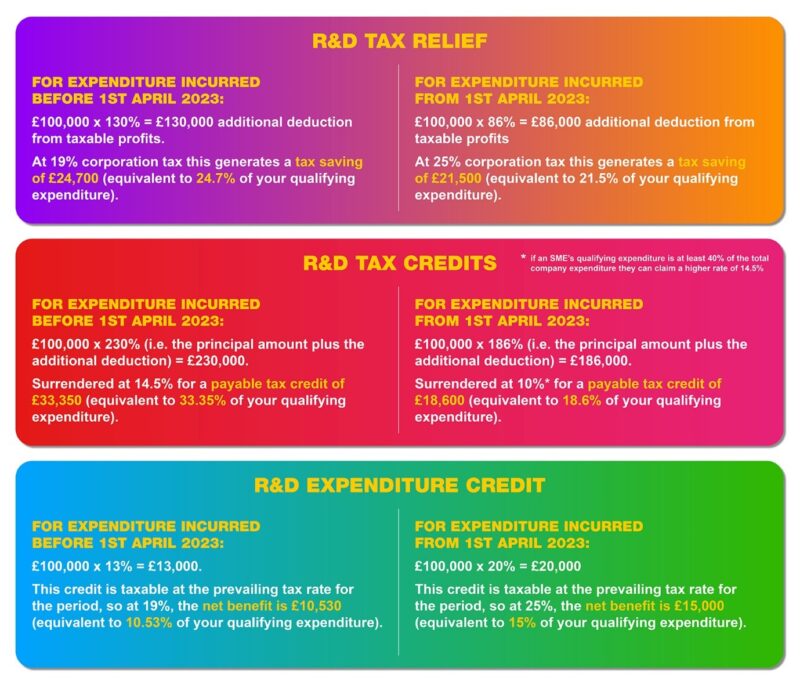

There are only three types of relief available, and each one has a specific name. If you hear anything else, it will likely be a collective name for some or all of the below.

This is the payable tax credit available for loss making SMEs.

This is the payable credit available for claimants under the Large company regime.

This is the additional deduction from taxable profits available for profit-making SMEs.

The amount that your business receives depends on two factors: (i) the type of relief claimed (R&D tax relief, R&D tax credits or R&D Expenditure Credits); and (ii) the amount of qualifying R&D expenditure.

We cover qualifying R&D expenditure in our dedicated section here. As an illustration, for £100,000 of qualifying R&D expenditure, the benefit under each incentive is as follows:

R&D tax credits exist to encourage companies in the UK to innovate, take on technically challenging projects, create highly skilled jobs and grow their business and the economy. At Cooper Parry we love nothing more than supporting businesses locally and nationally and are proud to provide a route to funding innovation.

To qualify for R&D tax credits a company needs to be undertaking technical activities that meet the Department for Business, Energy and Industrial Strategy (‘BEIS’) Guidelines on the Definition of R&D for Tax Purposes (you can download your own copy of the BEIS Guidelines here).

So, what are the BEIS Guidelines, what do they tell us and how do you apply it to your company?

To ensure that the generous incentives provided by the Government are completely industry agnostic BEIS drafted guidelines back in 2004 (and later updated in 2010) to set out exactly what does and does not qualify for R&D tax credit purposes. In defining qualifying R&D activities, the Guidelines focus on two key criteria, and state that to qualify a project must be:

That all sounds well and good, but what does it mean in practice? What is this advance and uncertainty?

We can uplift or de-risk every claim. 100%. Even if your company has already made a claim talk to us. We’ve improved 100% of claims for our clients. Sometimes we uplift a claim. Sometimes we de-risk a claim which makes it more robust. Ensuring its correct. Basically, less wrong! We put in time and effort to ensure your claim is the best it can be. We’re different because we don’t expect you to write the claim yourself. We don’t restrict the time available for exploratory work. You’ll always get a copy of YOUR report.

We’ve worked on R&D tax credits and incentives since it all started in 2000. And our Tax Partner Chris Knott is involved in HMRC’s R&D Consultative Forum that helps set Governmental policy on R&D incentives. That means we know how it works and we understand the context behind each change. Not only are our team part of Tolley’s 2018 Best Regional Tax Practice, but they also specialise in technical areas such as IT, Engineering and Manufacturing, Food, Pharmacology and Science. So, when it comes to your business, whatever the industry, we know what we need to find. We have a proven ‘CP way’ of doing claims that works every time. Our experience means we understand what exactly can be claimed and what red-flags to avoid.

You might consider R&D tax credit claims to be onerous and painstakingly slow. But with our experience, approach and relationship with HMRC, we have a slick process for getting claims submitted and approved. We’ll also keep you informed along the way. And we love visiting clients – their workshops, factories and offices. We’ll show you exactly what you can claim in real-time, and in good time. Fancy showing us around? We put time into getting to know your business. Our discovery meeting kicks off the process.

“Team efficiently led by Zahib under the tutorage of Katie, focusing on the key issues early, rather than the routine chaf, whilst working effectively with our central team and local teams. NED’s like the comms, telling us the issues rather than maybe other advisors telling us how wonderful they are. I’ve just about got used to the colour scheme 😉 . Already recommended CP – says it all!”

“Good communication, proactive team.”

“Extremely professional and pragmatic – a breath of fresh air.”

“Excellent delivery.”

“Efficient and personable service with a good understanding of our business.”

“Well planned audit, good communication and team on site showed a great understanding of the business.”

“We have excellent access to our audit partner. The audit team are professional and the assignment is well ran and to time. The quality of reports is great and everyone likes the way they are presented. We have tapped into other advisory services and found the support and advice excellent. Can’t think of any improvements needed.”

“Easy to work with, responsive and to the point.”

“Great service, competent and low maintenance (in a nice way!).”

“Very smooth audit, and turned round very quickly. Thank you!”