Are You Ready for HMRC’s new RDEC Regime?

Mark Frost

6 minute read

1 Reply:

We can help you join the dots and access funding and investment before starting on your R&D journey.

Research & Development (R&D) incentives claims are a core part of the support the CP Innovation team offer companies. Take a look at the information below which will tell you more about R&D incentives and the potential benefits for your company. Then talk to us.

The R&D tax incentives regimes have been designed to incentivise companies incurring costs undertaking scientifically or technologically challenging projects. It is called “R&D” but the sort of projects which can qualify are much broader.

R&D for tax purposes occurs when businesses actively develop new products and processes OR “appreciably improve” existing ones. It helps businesses remain competitive in their marketplace, whilst striving to push the boundaries of what can currently be achieved in their industry. However, we’ve found “R&D” is a bit of a red herring. Taken at traditional face value it sets the bar in the wrong place in people’s minds about what qualifies and what doesn’t.

We remove the misconceptions. And we’ll show you there’s a lot more to R&D incentives than just brand-new blue-sky research and thinking (usually associated with the likes of rocket science and pharma).

Put simply, it comes down to two things, CHANGE and CHALLENGE:

So, if you’ve made changes that took some thought and sleepless nights – it’s time for us to talk.

Let’s talk today

Want us to call you? Let’s start a conversation!

This is the package of financial support provided to UK businesses by the Government via the tax system to encourage R&D activities. In other words, a mechanism by which to reward companies for the development of new or improved products, processes, and services.

The CP Innovation team is experienced in working with companies to make sure they’re providing the information HMRC needs. Our reputation is based on the quality of our submissions, providing HMRC with what they need to make a positive assessment of your incentives claims. We will also tell you if we don’t think your claim will be successful based on current HMRC guidance!

We’ve worked on R&D tax credits and incentives since it all started in 2000. And our Tax Partner Chris Knott is involved in multiple Working Practice Groups seeking to raise standards in the R&D incentives claims industry. Specialising in technical areas such as Engineering and Manufacturing (everything from automotive to aerospace, chemical to nuclear), Food & beverage, IT, Pharmacology and Chemistry. So, when it comes to your business, whatever the industry, we know what we need to find. We have a proven ‘CP way’ of doing claims that works. Our experience means we understand what exactly can be claimed and what red flags to avoid.

Over recent years there has been abuse of the R&D tax regime by unscrupulous advisors. HMRC increasingly carry out compliance checks and it can be challenging and time-consuming to get claims approved by them. We’re confident in our approach and we’ll be by your side from start to finish.

Your business has fewer than 500 employees and either less than €100 million turnover or €86 million gross balance sheet assets. This is measured on a global group basis, so if your business is part of a group, or connected to other businesses (as a linked or partner enterprise – we can advise on these), you may need to consider their financials (or a portion of them) as well.

If your company is not eligible to claim under the SME criteria mentioned above, you may be in a position to claim under the large company scheme. This is also known as the R&D Expenditure Credit (‘RDEC’).

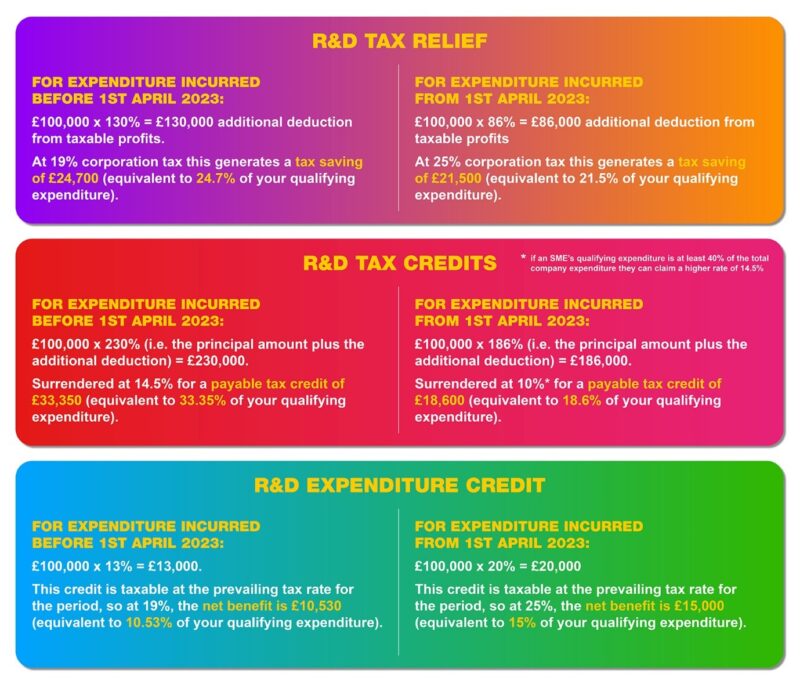

There are three types of incentives available, and each one has a specific name. If you hear anything else, it will likely be a collective name for some or all of the below:

This is the additional deduction from taxable profits available for profit-making SMEs.

This is the payable tax credit available for loss-making SMEs.

This is the payable credit (RDEC) available for all claimants under the Large company regime.

The amount that your business receives depends on two factors: (i) the type of relief claimed (R&D tax relief, R&D tax credits or RDEC); and (ii) the amount of qualifying R&D expenditure.

As an illustration, for £100,000 of qualifying R&D expenditure, the benefit under each incentive is as follows:

We’re committed to ensuring that you submit a good quality, realistic claim. We’ll tell you if we don’t think your claim will be successful before you start the process (or if that becomes apparent further into the claim process). We’re experienced in providing HMRC with what they need, based on years of experience from across a variety of industries.

We work on a fixed fee basis which means you’ll know exactly how much submitting a claim will cost you. If HMRC does decide to carry out a ‘compliance check’ on your claim, we’ll be by your side to help you through it.

You might consider R&D tax incentives claims to be onerous and painstakingly slow. But with our experience, approach and relationship with HMRC, we have a slick process for getting claims submitted and processed. We’ll also keep you informed along the way. And we love visiting clients – their workshops, factories and offices. We’ll show you exactly what you can claim in real-time, and in good time. No one has a Tardis, so why are people turning this into a memory exercise by leaving claims so late to prepare?!

Fancy showing us around? Let’s put some time into getting to know your business.

“Great communication.”

“Although the service we have received has been extremely good, there has been long delays in partner reviews.”

“Great relationship with Audit Partner and Audit Manager which means resolutions are reached quickly on difficult and complex issues. The accounts are put together in an efficient and well presented manner. The audit team generally adopt a logical and pragmatic approach. Only real negatives were that Kennedy audit was a more a drawn out process than perhaps it needed to be. Reconciling the consolidated accounts back to the Cooper Parry calcs was complex and there were some small discrepancies. As discussed with the Audit Partner I do have some concerns on the level of fees.”

“Great conference, helpful team and super service. Thank you.”

“The account were turned around quickly, and we were kept up to date with the progress of the audit”

“Easy communication, always get back to me promptly, provide advice when needed, like the Inflo system very user friendly.”

“The recent external audit and financial statement preparation were executed with professionalism and thoroughness. The auditor team demonstrated strong technical expertise and diligence, ensuring the process was both comprehensive and transparent. Their approach to testing, particularly in collaboration with the ASCL PD team during the first week, was highly effective and contributed to a smooth progression of the audit work, especially given its proximity to the annual conference. One area of improvement would be the timeline planning. The current schedule presents significant pressure in ensuring all necessary work is completed within tight deadlines. We have already discussed the potential benefits of moving some of the audit activities forward and setting clear dates in advance. Proactively scheduling key milestones would allow for better resource allocation and smoother execution. Another area of improvement would be the team working with their internal colleagues to check the partial VAT and advise on the changes to make for the next financial year. Additionally, the format and content of the audit findings report received positive feedback from elected officers. Its clarity and structure enabled effective review and discussion, reinforcing its value in financial oversight. Overall, the service provided was impressive, and the auditors’ commitment to delivering a high-quality review is appreciated. With a few refinements to planning and scheduling, the process could become even more efficient in future audits.”

“Great team, fit well into our office, professional approach whilst both friendly and very supportive. Pleasure to work with.”

“Communication was excellent and timely and the upload and action processes very smart and effective. Audit staff were friendly and helpful throughout the process.”

“Just very easy to deal with, all very relaxing to be honest!”