Corporate Finance

Company name:

Gemini Accident Repair Centres Limited

Deal Type

Sell Side Lead Advisory

Country

United Kingdom

Buyer Name

Steer Automotive Group

Country of Buyer

United Kingdom

Sectors

Industrials

1 Reply:

Cooper Parry Corporate Finance advise business owners who want to sell their business or grow their business through private equity investment.

Cooper Parry Corporate Finance advise business owners who want to sell their business or grow their business through private equity investment. Our UK team is supported by Reach Cross-Border Mergers and Acquisitions, a highly active international network of partner firms, working closely with investment banks and corporate finance boutiques across 30 key deal-making countries to find buyers that others can’t.

Selling your business is a huge event. Financially and emotionally. So, you need to work with the right advisor – one who can find the best buyer for the enormous value you’ve created, at the best price.

You need a team of advisors who really understand your industry’s buyers, value drivers and market opportunities, as well as having masses of experience in getting deals across the line.

We’ll lead your business through a sale, making sure it’s as smooth as possible, so you can continue running your business and hitting targets throughout the process.

If you’re looking for investment, our team will help you select the right private equity investor for you, your business, and your sector. We’ll negotiate the best terms and then facilitate the relationship between you and your preferred funding partner. We also have masses of experience in advising management buy-out teams.

Our Deal Origination team is an ever-growing, ever-important part of Cooper Parry Corporate Finance too. They connect us with great businesses in sectors where our expertise lie, analysing trends, creating and providing relevant and insightful market and deal information.

We’d love to meet you and your business well in advance of any transaction. That way, you can get the best possible outcome for your shareholders, your team, and your business.

Corporate Finance

Company name:

Deal Type

Sell Side Lead Advisory

Country

United Kingdom

Buyer Name

Steer Automotive Group

Country of Buyer

United Kingdom

Sectors

Industrials

Corporate Finance

Company name:

Deal Type

Company Sale

Country

United Kingdom

Buyer Name

A J Gallagher Inc

Country of Buyer

USA (via UK subsidiary)

Sectors

Business Services

Corporate Finance

Company name:

Deal Type

Management Buy Out

Country

United Kingdom

Buyer Name

WestBridge, UK

Country of Buyer

United Kingdom

Sectors

Business Services

Let’s talk today

Want us to call you? Let’s start a conversation!

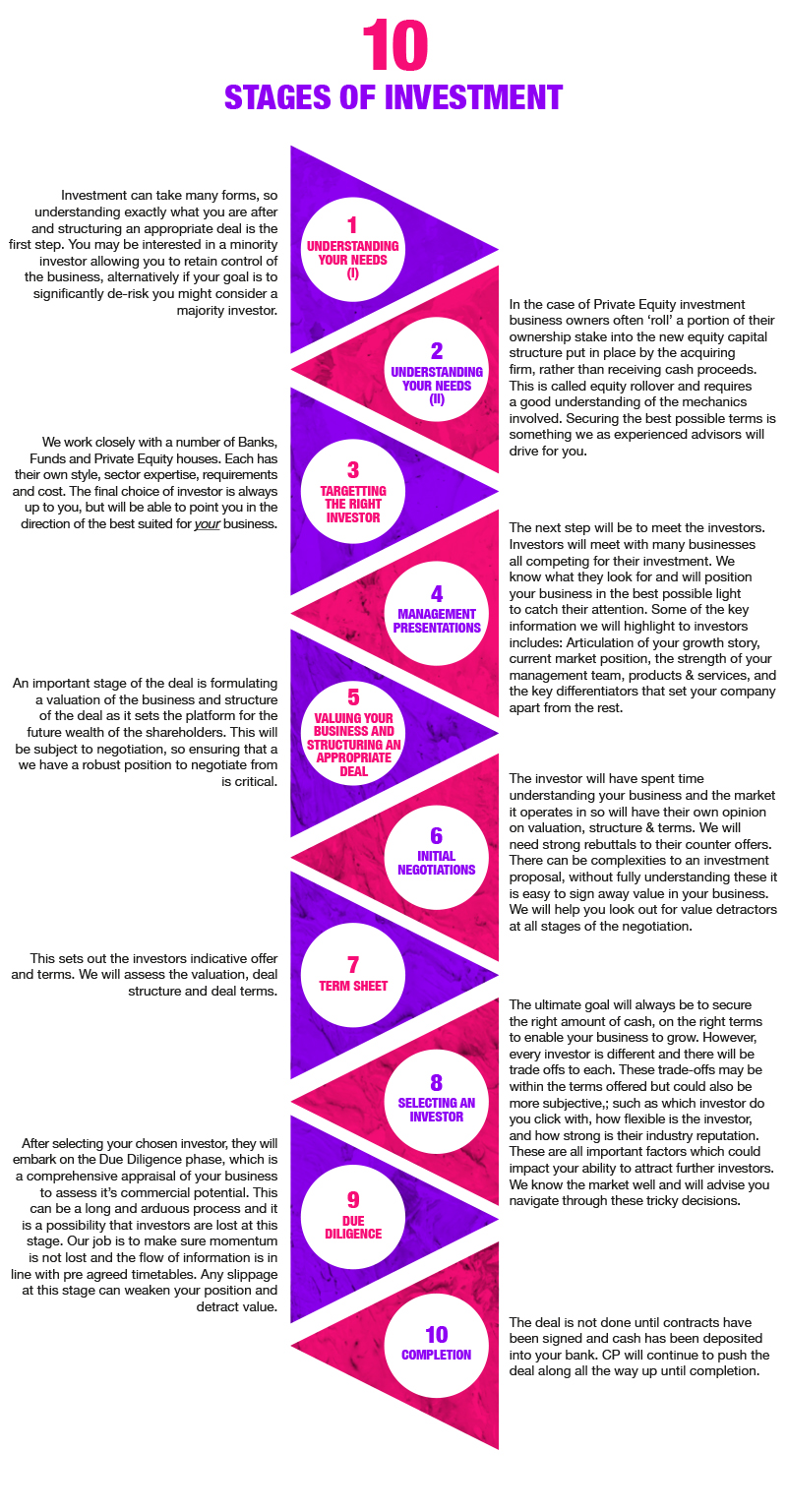

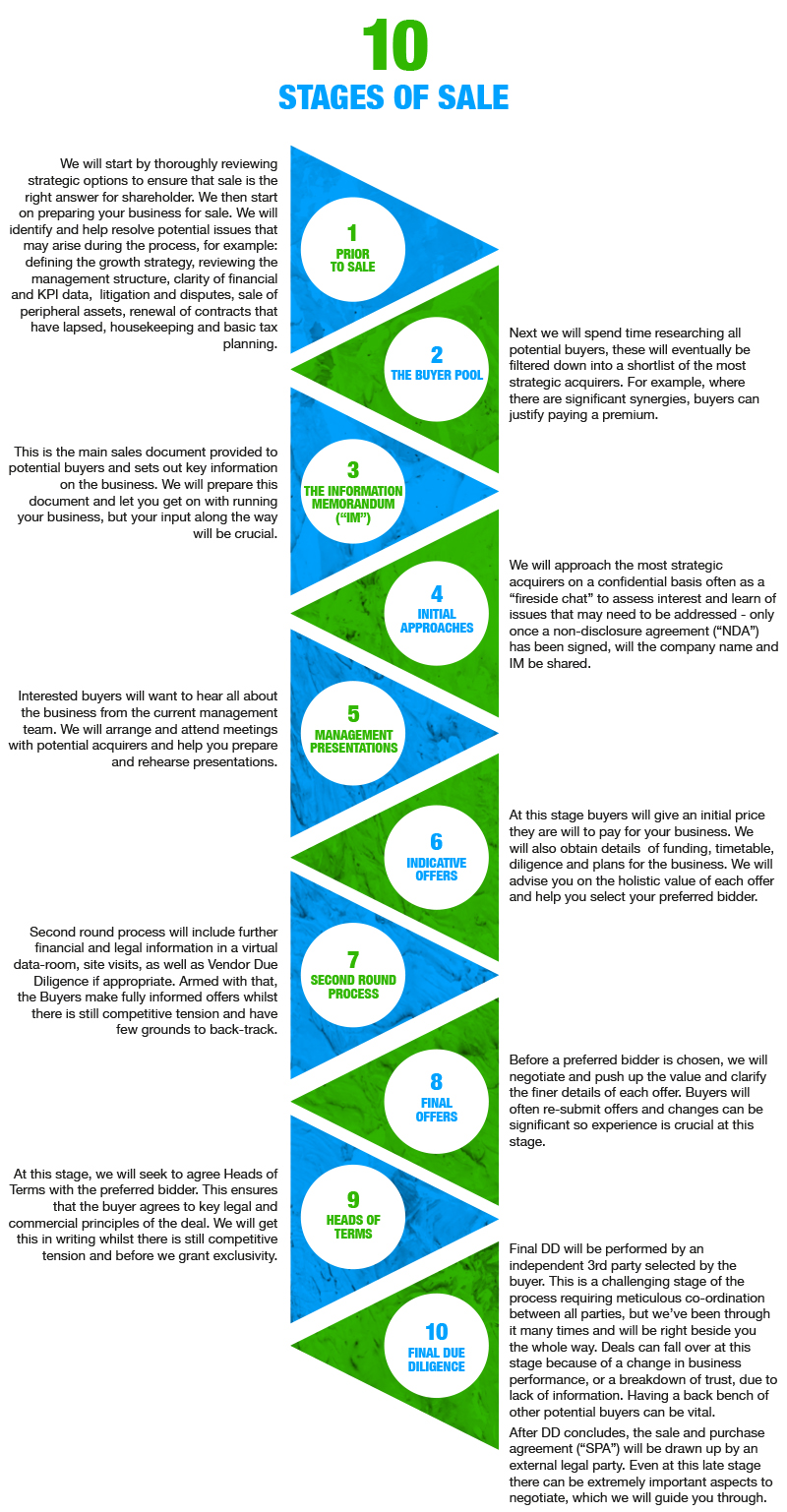

Our deal specialists are well versed on every step of the sales process. Here are the ten key stages from preparations prior to sale through to final due diligence.

The world of investment can be complex. Our deal experts know every twist and turn. On these pages they highlight the ten key stages from understanding a client’s needs through to joyous completion.